Do you have a trouble to find 'presentation on itr'? You can find all of the material on this webpage.

Table of contents

- Presentation on itr in 2021

- Income tax presentation pdf

- Income tax ppt presentation 2021-22

- Income tax ppt presentation 2020

- Income tax topics for presentation

- Ppt presentation on e filing of income tax return

- Introduction to taxation ppt

- Types of income tax return ppt

Presentation on itr in 2021

This picture demonstrates presentation on itr.

This picture demonstrates presentation on itr.

Income tax presentation pdf

This image shows Income tax presentation pdf.

This image shows Income tax presentation pdf.

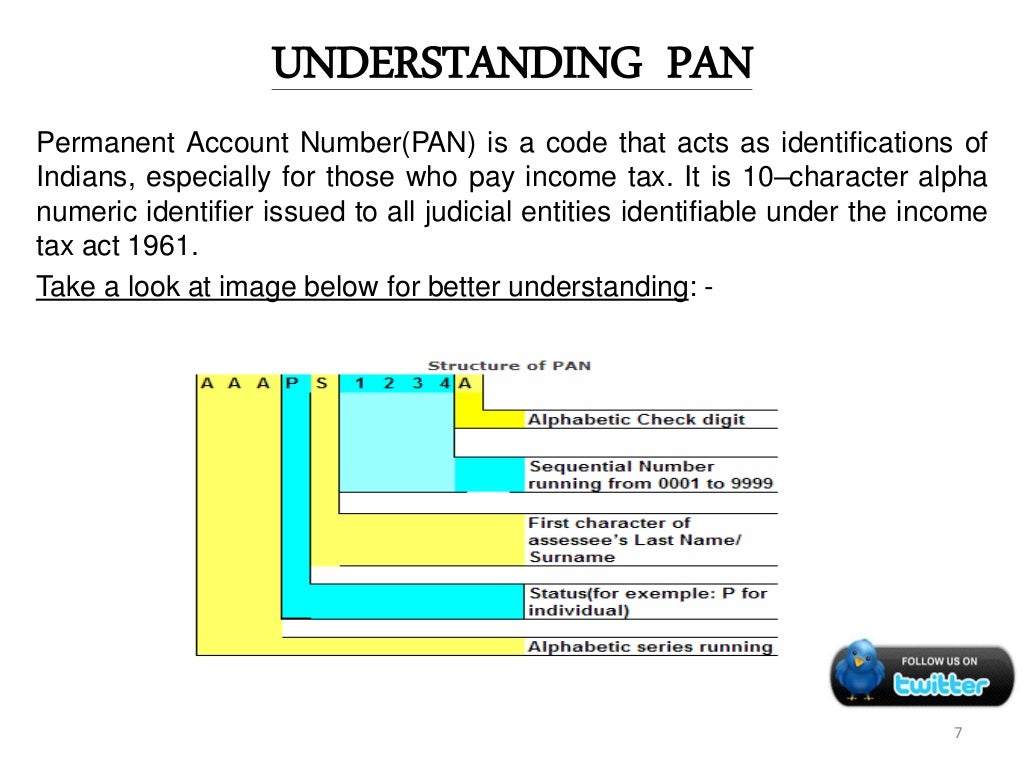

Income tax ppt presentation 2021-22

This picture shows Income tax ppt presentation 2021-22.

This picture shows Income tax ppt presentation 2021-22.

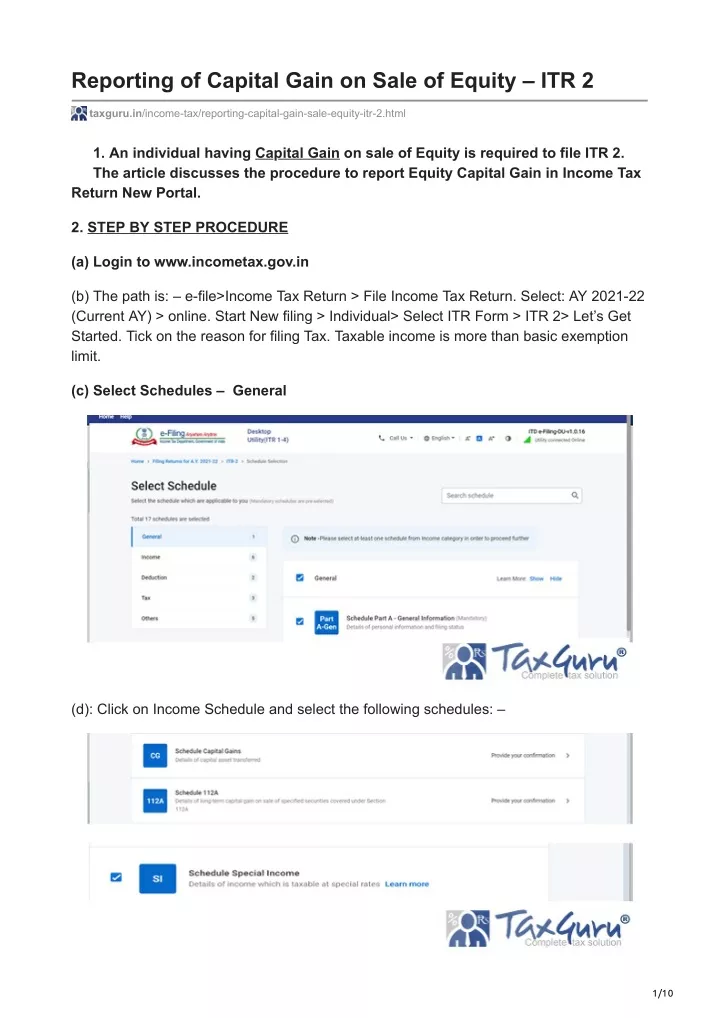

Income tax ppt presentation 2020

This image demonstrates Income tax ppt presentation 2020.

This image demonstrates Income tax ppt presentation 2020.

Income tax topics for presentation

This image representes Income tax topics for presentation.

This image representes Income tax topics for presentation.

Ppt presentation on e filing of income tax return

This image shows Ppt presentation on e filing of income tax return.

This image shows Ppt presentation on e filing of income tax return.

Introduction to taxation ppt

This picture illustrates Introduction to taxation ppt.

This picture illustrates Introduction to taxation ppt.

Types of income tax return ppt

This picture demonstrates Types of income tax return ppt.

This picture demonstrates Types of income tax return ppt.

How to calculate income from salary in ITR?

25. www.mymuneemji.com Points to remember while filing ITR-I ▫ Income from the head “ Income from Salary” should match with TDS information given in Schedule “ TDS1” ▫ Use “Calculate Tax” option after entering all information including verification details. The utility will calculate Tax automatically.

What should be included in ITR general 7?

23. www.mymuneemji.com Points to remember while filing ITR – General 7. In case of ITR – 3 and ITR – 4, if Total income exceeds Rs 25 Lakhs, particulars of assets and corresponding Liabilities needs to be given in Schedule AL 8. Details of Foreign income and Assets to be specifically mentioned.

Which is ITR form cannot be used by HUF?

11. www.mymuneemji.com ITR-4S (SUGAM) • The Form cannot be used by : ▫ Individual/HUF having Income from speculative business and other special incomes. Income from profession as referred to in section 44AA (1). income from agency business / commission / brokerage. Presumptive income but the assessee wants to get himself audited u/s 44AB.

How to file an itr for a business?

How to File an ITR Personally. Download, fill out, and print three copies of the accomplished BIR Form No. 1701A (Annual Income Tax Return for individuals earning income purely from business/profession). If you're required to pay taxes, go to the accredited bank of the RDO where you're registered.

Last Update: Oct 2021

Leave a reply

Comments

Demitrice

22.10.2021 03:53Components for light and heavy vehicles. How to file income revenue enhancement return online?

Eleno

26.10.2021 03:29The first step is to login into online income taxation filing. These assessee rich person filed the coming back in itr 7 to claim the refund of tds.

Carine

26.10.2021 06:02Itr-2- income tax coming back form 2 is applicable for those who do non have any income from business surgery proprietary firms. Cheap ripe to ship taxation folders.